Key Takeaways

- AI is no longer a disruptor but a central force in FX, driving automation, speed, and decision-making beyond human reaction times.

- Traders’ roles are evolving toward strategic oversight, creativity, relationship management, and nuanced decision-making where human judgment excels.

- AI-powered dashboards and natural-language tools enable proactive client engagement, real-time insights, and more personalized service.

- Success depends on blending algorithmic efficiency with human creativity, intuition, and relationship-building.

The FX industry is undergoing a profound transformation. AI is no longer a future disruptor; it’s already reshaping how desks operate, make decisions, and deliver value. With algorithmic trading and automation becoming increasingly central, the question is no longer whether AI will redefine FX desks, but how those desks can become fully AI-ready without losing their human edge.

One thing is for sure: Today’s markets move faster than humans can respond to. As the pace of markets continues to outstrip human reaction times, more automation is inevitable, and trading desks are likely to become smaller. But that doesn’t mean the end of human relevance. Instead, roles will evolve toward higher-value activities.

Strategic oversight. Creative problem solving and innovation. Backtesting and scenario analysis. System development and optimization. Client relationship management. People remain vital in these domains, working alongside AI to drive performance and create value.

The AI horizon

With that in mind, let’s explore what a modern AI-ready FX desk can look like, where to focus for success, and how people can thrive at the intersection of AI and human expertise.

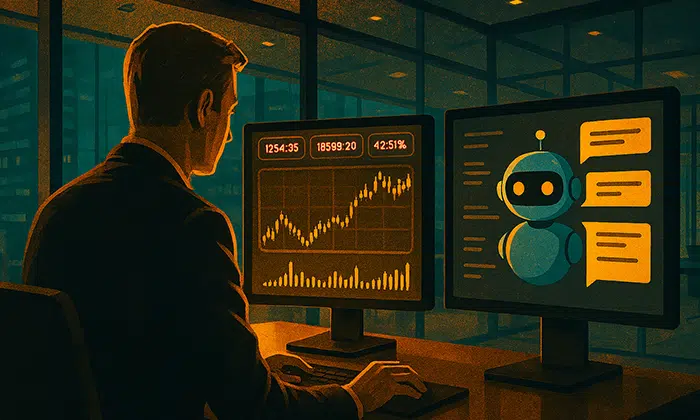

- Accessibility through natural language: AI-powered natural-language interfaces are democratizing access to advanced analytics and market insights. Traders can now query vast databases of structured and unstructured data using natural language, removing barriers for those without deep technical backgrounds and specialist coding skills. This means more professionals can surface insights into client trading patterns, identify opportunities, and find new ways to serve clients more effectively.

- Proactive client engagement and real-time insight: An ideal FX desk is so rich in intelligence and information that traders can anticipate clients’ needs rather than merely react to market events. AI-driven dashboards and interfaces with real-time analytics can leverage historical data to guide smarter decisions. That may involve identifying the best liquidity providers amid volatility or using unstructured data to spot activity dips and then proactively engaging those clients with tailored offers to entice trade.

- Soft skills and relationship management: As AI and automation handle increasing portions of routine trading, the importance of human skills is amplified. Intuition, strategic market insight, and relationship management become irreplaceable core differentiators. In a data-rich environment, elite traders interpret and build upon nuanced data, nurturing trust while exploring new opportunities with clients, cultivating relationships, and negotiating with liquidity providers in fast-evolving conditions.

- Human creativity and the ‘art form’ of trading: The best outcomes at today’s FX desks come from a smart blend of optimal algorithms and trader expertise, especially when interpreting complex or novel market conditions. This goes beyond mere execution, encompassing an ability to interpret subtle signals, spot patterns, experiment, and apply creativity. AI can process, synthesize, and suggest, but it is human judgment that can still elevate trading from a science to an art form.

- Proving value in an age of automation: In a world of increasingly algorithmic and AI-driven trading, the human contribution must be clear and compelling. FX professionals will increasingly need to prove their worth by demonstrating how they add value that algorithms alone cannot. They must show how deep insight, intuition, and client understanding can generate revenue and deliver a competitive edge.

How KX helps

KX tools are designed to help you harness the best of both AI and human expertise through selective iteration, backtesting, and nuanced decision-making. With our tools, modern FX desks can accelerate their transformation to better act with speed and insight, anticipate client needs, spot emerging opportunities, and maintain the crucial human touch that defines world-class trading.

In this new era, winning will mean embracing the power of AI while preserving and amplifying the human ingenuity that’s long been at the heart of the FX industry.

Visit the KX Financial Services hub to learn more or download our latest ebook and discover how to turn AI potential into production-ready impact through five proven use cases.