What’s holding your AI strategy back?

AI is already boosting productivity and unlocking alpha across capital markets—but most firms remain stuck in experimentation mode. This report, based on responses from over 2,000 analysts, CIOs, and CDAOs, explores what separates firms making progress from those falling behind.

From data infrastructure to analyst empowerment, we reveal the real blockers and what it takes to overcome them.

Ready to move from experimentation to execution?

Download the full report and discover how high-performing firms are building their edge.

Download your copy

"*" indicates required fields

Investment in AI is increasing

52% of technology leaders have seen their firm invest over $5 million in AI since 2022 with 28% saying over $10 million

This level of commitment demonstrates a clear recognition of AI’s potential to reshape capital markets. And the momentum is far from slowing down. Over the next 12 months, 35% expect their organizations to increase spending by at least 20%, while 17% anticipate growth of more than 40%.

This acceleration shows that firms are not just experimenting but embedding AI into the heart of their business strategies. As these investments expand, the firms that prioritize real-time data, trusted infrastructure, and scalable platforms will be positioned to turn spending into measurable advantage.

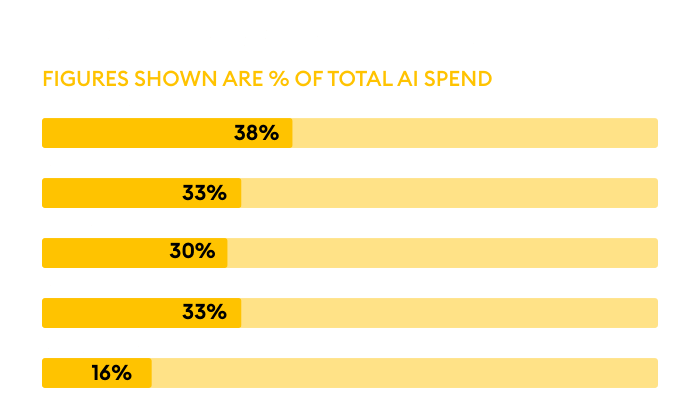

The main data challenges faced impacting continued investment in innovation:

40%

Ensuring data quality

35%

Ensuring data integrity

33%

Governance concerns

AI is a booster

Quants report a 62% productivity gain from AI.

Almost every quant surveyed acknowledges that AI has enhanced their effectiveness, helping them move faster and deliver greater value to their organizations.

The impact goes beyond time saved; it includes sharper decision-making, reduced manual and repetitive work, and the ability to optimize strategies with higher accuracy and personalization. These gains are compounding as firms refine their AI approaches.

By freeing analysts to focus on innovation and insight, AI is enabling the discovery of new signals, smarter trading decisions, and a greater ability to anticipate risk. For many, it already feels less like a tool and more like a competitive multiplier.

However, quants cite the following as blockers to experimenting with GenAI in their role:

38%

Not a strategic priority yet

32%

Lack of expertise/talent

27%

Infrastructure/data readiness

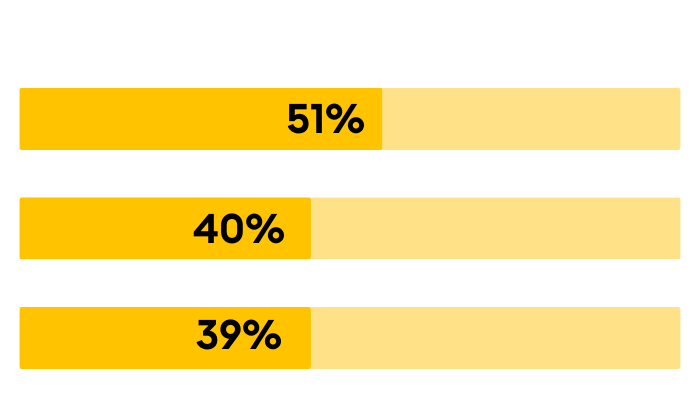

Analysts are pushing technology boundaries

70% of quants want more advanced technology for real-time data analysis and decision-making .

Their expectations reflect both the critical nature of their role and the pace at which markets evolve. Quants are clear: access to the right technology can mean the difference between leading and lagging. They want platforms that can handle vast data sets at low latency, provide reliable infrastructure for experimentation, and give them confidence in compliance.

With so much at stake, quants are also asking for a stronger voice in technology choices, ensuring their needs are heard and acted upon. Organizations that empower them are not only giving their teams the best chance to succeed but also creating a culture where innovation becomes part of the competitive DNA.

81%

Of quants want more influence over tech choices

24%

Say a fully in-house AI stack would make them more effective

48%

Say current GenAI solutions ‘feel limited’

IT at risk of being overwhelmed

66% of CIOs and CDAOs feel overwhelmed by analyst demands for AI and innovation.

While most (65%) tech leaders prioritize innovation over risk reduction, the pressure is mounting. Shadow AI, compliance concerns, and escalating performance demands are putting even mature organizations under strain. But there is mutual recognition for the challenges faced between the front and back office.

- 75% of IT and data leaders say analysts are demanding access to new AI technology and tools faster than they can deliver them

- 87% of technology leaders believe that shadow-AI initiatives could put their business at risk

- 73% of quants acknowledge that IT leaders are in a difficult position

A clear competitive advantage

Aligning analysts and IT can deliver a 6.6-month edge over the competition.

That extra time gives firms the ability to test new strategies, refine models, and seize opportunities before the competition even reacts. The advantage is already being realized by organizations that reduce friction between quants and IT and embed collaboration into their operating model.

With stronger infrastructure, shared goals, and unified data strategies, these firms move with greater speed and confidence. Analysts gain the tools and trusted data they need to innovate, while CIOs and CDAOs ensure resilience, security, and governance. Together, this alignment turns AI from isolated pilots into enterprise-wide systems that scale effectively, creating an advantage that compounds over time.

Download the report

Unlock the full report to discover how quants and tech leadership are building momentum together.