Key Takeaways

- KX Flow is a comprehensive turn-key trading solution to streamline and optimize FX operations.

- KX Flow is extensible, integrating with downstream algorithmic solutions and external multi-bank portals.

- The implementation process is designed to be straightforward, minimizing disruption to ongoing operations.

Social and economic instability is today more prevalent than ever. Knowing your markets and identifying how they best align is therefore crucial. Foreign Exchange (FX) accounts for a volume of over 7.5 trillion U.S. dollars daily, making it one of the largest markets in the world. It enables countries and businesses alike to form a protective shield against tomorrow’s uncertainties while promoting international trade relations and investments from foreign lands.

In this blog, I will introduce KX Flow, a sophisticated trading technology designed for corporate, institutional, and retail FX organizations. It offers a user-friendly interface and advanced features that streamline FX trading processes, including:

- Real-time pricing and execution: Delivers live market data from upstream liquidity provider feeds, as well as features to allow for constructed client pricing

- Post-trade and transaction cost analysis: Fine-grained access to price and order behaviour for execution traces and cost analysis

- Integration with external applications: Ability to integrate APIs and other downstream applications to maximise potential

What is KX Flow?

KX Flow is a multi-tenant trading and analytics platform designed for high-performance, low-latency environments. Built upon the KX Delta Platform, it enables processing, analysis, and visualization of both real-time and historical data, which is particularly beneficial for extreme and often volatile tick data applications. Streaming liquidity is sourced from a catalogue of liquidity providers (LPs), offering executable streaming prices (ESP) and request for stream (RFS) pricing options.

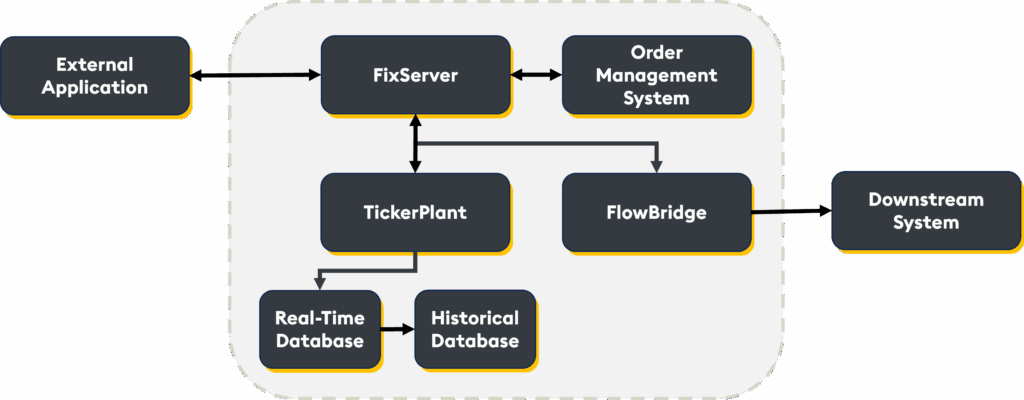

Architecture

KX Flow connects to external applications using custom APIs or multi-bank portal (MBP) connections via the FIX messaging protocol. There is also a custom UI built upon KX Dashboards for simplified administration and querying.

Components

- FixServer: Interface between KX Flow and external applications. FIX is a messaging protocol maintained independently by www.fixprotocol.org

- Order management system (OMS): Applies routing logic pre-execution (warehouse checks, min profit, position limits, etc)

- Tickerplant (TP): Captures messages from the pricing engine and writes them to memory

- Real-time database (RDB): In-memory process that stores the most recent, intra-day data. It subscribes to the tickerplant to receive real-time updates and allows users to query data with minimal latency

- Historical database (HDB): Stores large volumes of time-series data to disk, typically in columnar format, organized by date

- FlowBridge: Enables multiple systems to exchange kdb+ data. By subscribing to a definitive set of tables, it passes updates to downstream algorithmic systems when quote/order processing occur

KX Flow use cases

Real-time market data

A global FX trading desk wants to view a wide range of instruments and commodity data from all providers available, including spread deviation.

- KX Flow ingests real-time FX quote data from upstream sources (using dfxQuote and dfTakerDepth to filter to the user)

- Traders can view data via FXTrader (purpose-built UI solution), an API of their choosing, or via a multi-bank portal (MBP)

Benefit: Enables better pricing decisions and provides full visibility into current market data, aiding competitiveness and enhancing potential profitability.

Warehouse execution

A client wishing to avoid constant heavy charges from placing orders with LPs wishes to fill orders internally.

- KX Flow routing rules allow clients to configure subsets for warehouse trades

- Users execute against real-time streaming data; however, orders will not route to liquidity providers

- Order data will be stored in relevant tables (e.g. dOrderRequest, dOrderReport)

Benefit: Reduces overall total cost and improves fill rates, enhancing client satisfaction and trading performance.

External markup applications

A client wishes to make updates to markup applications multiple times per second.

- KX Flow achieves this using a downstream application in conjunction with an API process in under 20ms

- Data is communicated using a FlowBridge (tables include dfxPoolQuote and dfxQuote)

Benefit: Enables more competitive pricing to be published, in line with the velocity of market data updates, while enhancing the prospect of profitability.

Disclosure and ease of reporting

To align with best practices of regulation, the client would like to view the actions undertaken by all users of the system.

- KX Flow provides an event audit log to view actions undertaken by users, both intra-day and historically

- Authentication, administration, and relevant usage tracking are logged

Benefit: Provides clear transparency to owner users regarding the actions taken, aiding in ease of reporting.

KX Flow is a powerful, flexible, and high-performance FX trading platform that empowers traders with real-time insights into market data, advanced trading options, and seamless integration capabilities. Its combination of streaming analytics, robust support for APIs, and innovative order management makes it a compelling choice for institutions seeking to optimize their foreign exchange (FX) trading operations.

Book a demo to find out more.