Professionals working in the fixed-income trading and portfolio management space know that maintaining a competitive edge demands near instant access to high-frequency data and the ability to swiftly and precisely interpret it.

Traditional methods are becoming inefficient due to increasing data volume complexities, which lead to decision-making hurdles for both traders and portfolio managers.

The challenge

In the recent Fixed Income Leaders Summit, experts highlighted the growing correlation between credit markets and listed cash markets, arguing that traders now need to consider both underlying securities and treasury futures when trading bonds.

On top of this, organizations are shifting from recruiting large trading teams in favour of technical specialists and compact, highly competent teams to manage data and construct models.

Tied in with the operational challenges of managing multiple data pipelines, financial firms are now looking for ways to streamline and simplify processes.

The solution

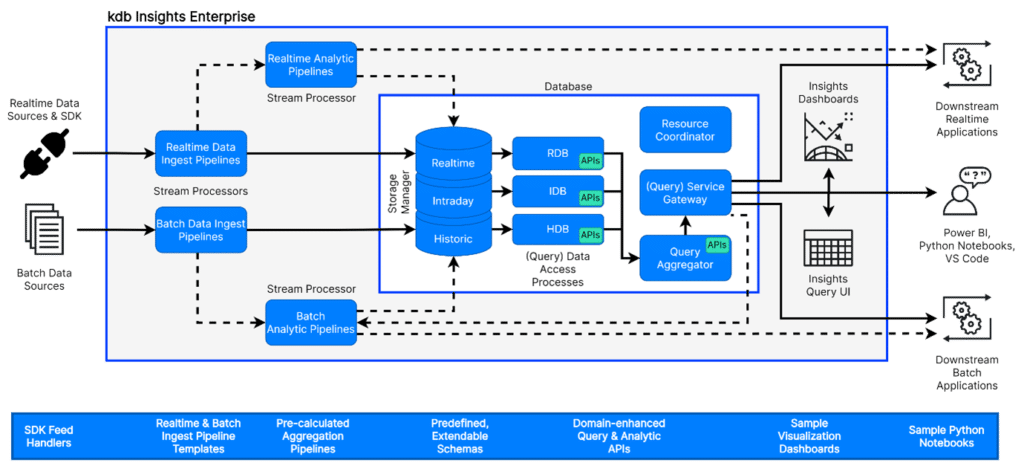

Working in association with Intercontinental Exchanges (ICE), KX are pleased to introduce the “Fixed income accelerator” designed to ingest real-time, historic, and reference data from ICE’s fixed income data services for analysis in kdb Insights Enterprise.

Eliminating the need to manually configure the infrastructure, deployment times are significantly reduced, allowing tick-level data to be streamed in real-time via custom analytic pipelines that can be queried using industry standard tooling such as SQL, Python and q.

Features include

- Integration with ICE’s extensive data sets, including interest rates, bonds, and related indices

- Advanced tools for spread, treasury analysis, sector comparisons, and ratings for detailed market insight

- Reduced model development times to accelerate decision-making

- Friendly user interface that provides easy access to queries and visualizations

- Scalability to support dynamic analytical needs and the consolidation of intricate data sources

We believe that these features will significantly improve decision-making, operational efficiency and trading practices, empowering traders and portfolio managers to act faster with decisions that shift from traditional screen-based trading to model-based approaches that align with market trend.

Find out more by visiting our documentation site or contact sales for further details