From reactive models to real-time foresight

Forecasting in capital markets demands more than historical averages or static models. Market behavior is nonlinear, multivariate, and constantly evolving. Deep Learning Forecasting empowers analysts to build dynamic, adaptive models that predict what’s coming, not just explain what happened. By combining deep learning with real-time infrastructure from KX, you can transform fragmented signals into forward-looking insight that supports faster, smarter decision-making.

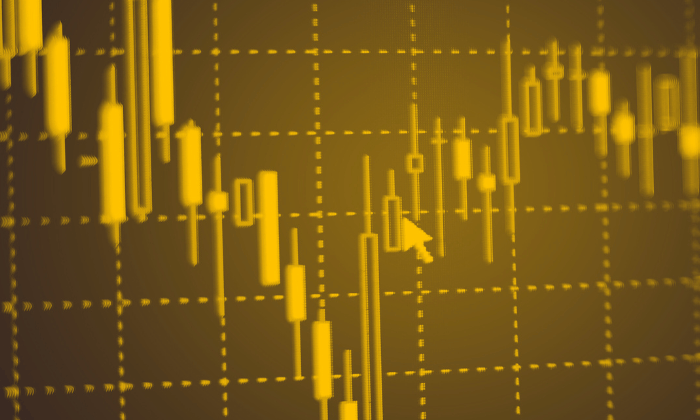

Market-ready yield forecasts

Forecast US, UK, and EU government bond yields using LSTMs, Temporal CNNs, and hybrid deep learning models trained on real-time and historical data.

Inference for live pricing

Integrate deep learning outputs directly into quoting workflows to enhance pricing precision and anticipate shifts in yield curves or spread behavior.

Macroeconomic signal modeling

Predict inflation trends, rate moves, or policy shocks using multivariate deep learning models trained on macroeconomic and market signals.

Adaptive modeling at scale

Continuously retrain models on streaming data with real-time feedback loops, keeping forecasts current as regimes evolve and new data flows in.

Key capabilities

KX enables deep learning forecasting by combining high-performance time-series infrastructure with the flexibility to support advanced model architectures. With built-in support for continuous retraining and real-time inference, teams can develop adaptive forecasts that respond to shifting market conditions. These are the use cases it unlocks:

Model future outcomes with deep learning and real-time data

Move beyond static models with advanced deep learning architectures like LSTMs, Temporal CNNs, and hybrid RNN-CNN frameworks, plus emerging models like Mamba designed for long-range, real-time prediction. These architectures improve forecast accuracy, reduce model decay, and adapt better to shifting market regimes.

Use cases include:

- Predicting asset returns and market volatility

- Forecasting macroeconomic and sector indicators

- Estimating cash flow or investor behavior over time

- Supporting execution strategies with forward-looking models

Identify unusual events before they cause disruption

Detect irregularities in price, volume, or flow by analyzing the shape and structure of time series data. Use models like autoencoders or GANs to flag unexpected behaviors without relying on predefined labels or static thresholds.

Use cases include:

- Highlighting rogue trades or flash crashes

- Detecting abnormal trading behavior in real time

- Identifying potential fraud or operational risk events

Label regimes, risk, and sentiment across varied inputs

Classify time-series or unstructured inputs using models such as transformers, RNNs, or feedforward networks. Segment market behavior, evaluate credit risk, or tag sentiment to support faster, more informed decisions.

Use cases include:

- Identifying shifts in market regimes

- Classifying credit profiles using mixed data

- Tagging earnings transcripts or news headlines

- Supporting compliance through real-time classification

Group data by behavior, not assumptions

Reveal structure in unlabeled datasets by applying clustering techniques like self-organizing maps, graph neural networks, or autoencoders. Surface hidden patterns in portfolios, asset classes, or client behavior.

Use cases include:

- Segmenting portfolios by risk, performance, or style

- Identifying asset clusters under market stress

- Grouping clients or accounts by behavioral traits

- Supporting exploratory analysis for product innovation

Improve decisions continuously with feedback-driven models

Use reinforcement learning methods such as DQNs or PPO to optimize decision-making over time. Models evolve with market conditions, refining strategies in response to real-world outcomes.

Use cases include:

- Optimizing order execution and trade sequencing

- Automating portfolio rebalancing based on live signals

- Adapting hedging strategies in volatile markets

- Managing dynamic portfolios under real-time constraints

Extract insight from unstructured text alongside time series data

Apply transformer-based NLP to ingest and analyze financial text alongside quantitative data. Uncover meaning in analyst notes, earnings transcripts, or regulatory filings to drive context-aware forecasting.

Use cases include:

- Monitoring sentiment across news and social platforms

- Surfacing macro signals from central bank statements

- Flagging compliance or disclosure risks

- Enhancing quant signals with unstructured insights

Overcome these challenges

Legacy forecasting models often fall short in today’s volatile, data-rich markets. They oversimplify complexity, miss critical long-range signals, and degrade quickly as conditions change. These limitations slow down decision-making and increase exposure. Here are the challenges that make forecasting difficult at scale:

Static models miss market complexity

Traditional forecasting methods fail to capture nonlinear behaviors and rapid shifts in market dynamics, making them unreliable for high-frequency or volatile environments.

Slow, manual model workflows

Manual feature engineering, validation, and tuning extend development cycles and make it difficult to adapt quickly to market changes or retrain models at scale.

Long-term patterns go undetected

Complex dependencies across timeframes and variables are often missed or oversimplified, preventing models from identifying slow-building trends or structural changes.

Forecasts decay as markets shift

Without real-time feedback and automated retraining, forecasting models degrade in accuracy as regimes evolve, new data arrives, and underlying patterns change.

Benefits

Move beyond reactive planning and enable real-time, deep learning–driven forecasting. With faster pipelines, scalable infrastructure, and adaptive models, teams can stay ahead of volatility and opportunity. These are the benefits that unlock competitive advantage:

Smarter, more accurate forecasts

Deep learning models uncover hidden patterns and improve long-range prediction accuracy.

Continuously optimized models

Automated updates and continual retraining keep models accurate as conditions evolve.

Faster time to insight

Accelerated workflows reduce lag from data collection to forecast-driven decisions.

Stronger predictive edge

Identify shifts in risk or opportunity before competitors react to changing market conditions.

Deep Learning Forecasting

Move beyond static models with adaptive deep learning pipelines that capture complex, nonlinear market behavior and retrain as conditions evolve.

How it works

KX and NVIDIA bring deep learning and high-performance analytics together to forecast what’s next. Deep Learning Forecasting ingests both live and historical time-series data, compresses and processes it in motion, and powers deep learning models such as LSTMs, transformers, and temporal CNNs using GPU-accelerated infrastructure.

From training to inference, everything happens in a unified, high-speed pipeline. Real-time feedback loops ensure models continuously adapt to changing conditions, allowing firms to stay ahead of volatility, identify emerging signals, and make decisions with greater confidence.

Stream-native data processing

Ingests and transforms high-frequency time-series data on the fly, reducing lag between signal detection, model update, and action, ideal for fast-moving markets.

Deep learning integration at scale

Supports seamless training and inference with PyTorch and GPU acceleration, enabling models to capture long-range dependencies and nonlinear patterns.

Continuous model refinement

Real-time feedback loops allow for automatic retraining and performance monitoring, keeping forecasts accurate as new data and market regimes emerge.

Why KX?

Time-series DNA

We were purpose-built for capital markets, with native support for high-volume, high-frequency, and time-aware data. From intraday volatility to long-horizon trends, we help teams extract insight across any timeframe.

Enterprise-grade scale

While other platforms falter at scale, we handle billions of rows in real time with sub-millisecond performance, meeting the latency, throughput, and compliance demands of the most data-intensive trading environments.

Faster path to value

We enable faster AI innovation in Capital Markets with validated high value use cases, NVIDIA-accelerated infrastructure, and tested frameworks that streamline deployment.