Introducing Temporal IQ for kdb+

- Search, analyze, and forecast time-series data with unprecedented speed and precision with Temporal IQ for kdb+.

- Optimize data analysis without duplicating or embedding external models for high-velocity similarity searches, pattern recognition, and anomaly detection across vast datasets to deliver real-time actionable insights.

Benefits

Designed for capital markets, use temporal similarity search on real-time data to test patterns or trends against your historical data to identify anomalies or forecast future events. Extract meaningful insights from massive time series data —all without needing complex models or data duplication.

Real-time insights

Instantly identify patterns in high-velocity data streams to capitalize on trading opportunities and mitigate risks.

Increased search performance

Search time series data 10x faster, providing results in seconds and improving decision-making speed.

Predictive power

Deploy advanced temporal analytics to forecast future trends and behaviors, giving you a competitive edge by making informed, proactive decisions.

Proactive risk management

Use predictive analytics to anticipate future events, helping you manage risk and stay ahead of market volatility.

Why choose Temporal IQ?

Built for kdb+, enhance your analytics without overhauling your systems. Our solution integrates seamlessly into your existing infrastructure, offering both performance and simplicity. With no need for embeddings or external models, Temporal IQ maximizes efficiency in detecting patterns and anomalies at scale.

How does Temporal IQ work?

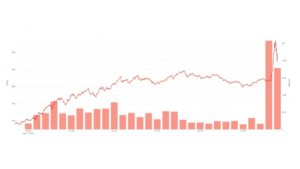

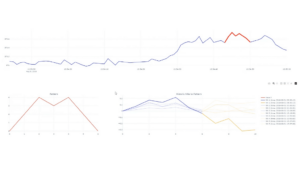

Leverage Temporal Similarity Search to identify patterns, trends, and anomalies within your time series data. This advanced search method returns the n nearest neighbor for a given pattern or curve, which provides a wider relevant search forgoing the rigid, rule-based approach that would return limited results. This flexibility enables businesses to unlock new insights from their data, whether through detecting emerging patterns or spotting anomalies in real time.

Pattern matching

Empower your teams to identify recurring trends in large volumes of historical time series data by searching for pre-defined patterns, firms can analyze market behavior and optimize trading strategies. Temporal IQ generates signals when specific patterns are observed, allowing firms to capitalize on trading opportunities. Additionally, it helps mitigate risk by detecting patterns that require immediate corrective action, enabling faster decision-making and improved performance.

Anomaly detection

Detect anomalies in real time and proactively address data feed issues as they arise. Enable immediate action when unexpected deviations occur, such as detecting and addressing order performance issue or quickly respond to anomalies related to algo execution, toxic order flow, or potential market abuse. Temporal IQ also helps detect changes in customer trading patterns, facilitating proactive outreach and risk management.

FAQ

Frequently asked questions regarding the application of Temporal IQ.

It is an advanced analytics solution designed for kdb+ that allows capital markets firms to search time series data for patterns, trends, and anomalies in real-time. It leverages high-performance temporal similarity search without needing complex models or data duplication.

It enhances search performance by up to 10x compared to traditional methods. It reduces time series windows and efficiently processes large datasets, returning results in seconds, even across billions of data points.

Yes, Temporal IQ is built specifically for kdb+ and integrates seamlessly with your existing infrastructure. There’s no need to move or duplicate data, making it a lightweight solution that works directly within your current setup.

It is optimized for analyzing time series data, which is common in capital markets for tracking historical price movements, trading patterns, and other temporal data points. It can handle both real-time streaming data and historical datasets.

It allows firms to proactively manage risk by detecting anomalies in real-time, helping prevent costly decisions based on bad data. Its predictive capabilities also enable firms to forecast future trends, improving decision-making and mitigating potential risks.

No, Temporal IQ does not require embeddings, complex models, or external tools. It directly utilizes your existing kdb+ data and performs similarity searches with no additional overhead.

It is ideal for detecting patterns in historical data to optimize trading strategies and for identifying anomalies in real-time to mitigate operational risks. These use cases are particularly valuable in high-frequency trading and market monitoring.

By identifying trends and patterns in historical and real-time data, Temporal IQ provides insights that traders can use to capitalize on market opportunities, improve profitability, and minimize exposure to risks.

Demo the world’s fastest database for vector, time-series, and real-time analytics

Start your journey to becoming an AI-first enterprise with 100x* more performant data and MLOps pipelines.

- Process data at unmatched speed and scale

- Build high-performance data-driven applications

- Turbocharge analytics tools in the cloud, on premise, or at the edge

*Based on time-series queries running in real-world use cases on customer environments.

Book a demo with an expert

"*" indicates required fields