In this episode of Data in the AI Era, host Peter Finter sits down with Time Magazine technology pioneer Mark Palmer to explore the future of GenAI in capital markets and how firms can unlock tangible value in the technology.

Be first in line to hear our next podcast by subscribing to our YouTube channel, Apple Podcasts, Spotify or your chosen podcast platform. If you have any questions you would like us to tackle in a future episode or want to provide some feedback, reach out to the team at podcast@kx.com.

Show notes

The discussion delves into the practical applications of AI in trading, the challenges firms face in AI adoption, and why AI should be seen as a co-pilot rather than a replacement for human decision-making. Mark shares insights on the parallels between today’s AI transformation and the rise of algorithmic trading, the role of simulations in financial decision-making, and the latest AI-driven innovations reshaping the industry.

Key takeaways:

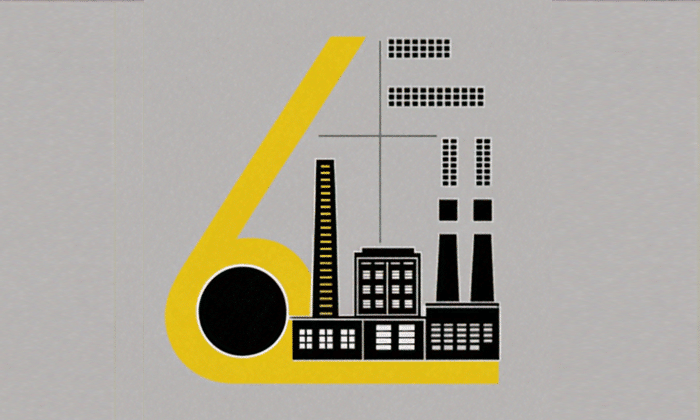

1. Only 6% of firms are seeing AI ROI—why?

A recent McKinsey report found that only 6% of firms are seeing significant returns on AI. Mark Palmer draws a parallel between today’s AI adoption and the early days of algorithmic trading:

“In the early 2000s, every magazine on Wall Street was predicting ‘the death of the trader’ due to algorithmic trading. Yet, at the time, only 5% of trading was electronic. AI today feels a lot like that—people are skeptical, but transformation is inevitable.”

The takeaway? Firms that approach AI strategically, solving real business problems, will be the ones that thrive.

2. AI as a co-pilot, not a replacement

A major misconception is that AI will replace human traders. Instead, Mark argues that AI is an augmentation tool, enhancing human decision-making rather than replacing it.

“It’s better to be a little bit slow and right than really fast and wrong. What generative AI allows traders to do is process an overwhelming amount of information quickly to make a smarter decision. Many traders are using generative AI as a ‘trading co-pilot’ to assist with decision-making rather than replace them.”

3. AI-powered simulations: Learning from Formula 1

Mark highlights a key lesson from Formula 1 racing: high-frequency decision-making benefits from AI-driven simulations. Just as F1 teams model millions of race scenarios, traders can use AI to anticipate market movements and refine strategies before execution.

“Advanced trading groups are leveraging generative AI for simulation—just like Formula 1 teams simulate millions of scenarios to prepare for race day. In trading, AI helps pre-imagine scenarios, using different data sources to optimize strategy before execution.”

4. Breaking down data silos with agentic AI and similarity search

Two AI-driven innovations are reshaping financial data analysis:

- Agentic AI: AI-powered agents that help firms break down data silos, improving access to real-time insights.

- Temporal similarity search: A technique used in KX’s Temporal IQ, allowing firms to spot trading patterns in structured data in real time.

“On Wall Street, similarity search and agentic AI are helping firms break down data silos and process high-frequency data more effectively. Technologies like stream similarity search are being applied in novel ways to structured financial data, allowing traders to spot patterns in real time.”

5. Where should firms start with AI?

For firms looking to adopt AI successfully, Mark suggests a crawl, walk, run approach—starting with small, high-value use cases before scaling AI initiatives.

“The best way to trust AI is to use it. Many executives I talk to are first experimenting with generative AI for internal use—summarizing regulatory reports, drafting emails, or analyzing legal documents—before deploying it at scale.”

Innovate at the edges

Mark encourages capital markets firms to borrow ideas from other industries—whether it’s Formula 1, retail, or intelligence agencies—to uncover new AI-driven opportunities.

“The most fascinating AI applications happen at the edge—where innovative firms are partnering with tech providers to solve real business problems. Wall Street has always thrived on leveraging cutting-edge technologies for competitive advantage, and AI is no different.”

Additional resources:

- The state of AI in early 2024: Gen AI adoption spikes and starts to generate value

- GenAI alone won’t give you an edge in 2025 — But these trends will

- Pattern matching with temporal similarity search

- Understand the heartbeat of Wall Street with temporal similarity search

- Turbocharge kdb+ databases with temporal similarity search

- Harnessing multi-agent AI frameworks to bridge structured and unstructured data