Events can mess up plans for anyone, but real-time events can really mess them up for traders. Political upheavals, natural disasters, even rumours of them, can instantly undermine the assumptions and projections behind carefully crafted strategies. As a result, they can quickly change from lucrative alpha-generators to disastrous loss-makers if remedial action is not taken – and taken quickly.

Consider, for example, a benchmark tracking VWAP. By definition, it depends on market volume, and as that volume increases in periods of high volatility, so must its execution rate to maintain its target level. That demands instant recalculation and recalibration of the trading profiles based on each successive tick as they arrive, while still incorporating historical prices for context. It leaves no room for the latency inherent in the traditional approach of capturing, storing and then reloading updates to perform the analysis. And it certainly leaves no room for batch.

The performance of an algo at run time is only as good as the signals feeding it. Remember Brexit, the Flash Crash of 2010, or Knight Capital in 2012 where algos either crashed or, worse possibly, blithely continued as they were. In such circumstances, an algo must instead be able to respond at the speed of the markets to avoid meltdown or uncontrolled loss. But it’s not just about what can go wrong. It’s about realizing opportunity too: it’s about refining or redefining those assumptions in real time, based on what’s happening right now, to further improve trading outcomes in those fleeting moments where those opportunities arise.

What is needed to achieve that is a streaming analytics platform that can capture, analyze and update events instantly and deliver insights to those who need them, when they need them. That includes traders, execution consultants, and clients, each with their own concerns in areas like profitability, efficiency, and TCA. Financial data can be notoriously difficult to manage, however. Its volume and velocity alone can overwhelm traditional databases. Its fragmentation, tendency to change, and noisiness demand significant pre-processing to ensure its consistency and accuracy when defining and back testing strategies. And that same rigor is required at run time to monitor its performance – at a processing and execution level and also at a PnL level.

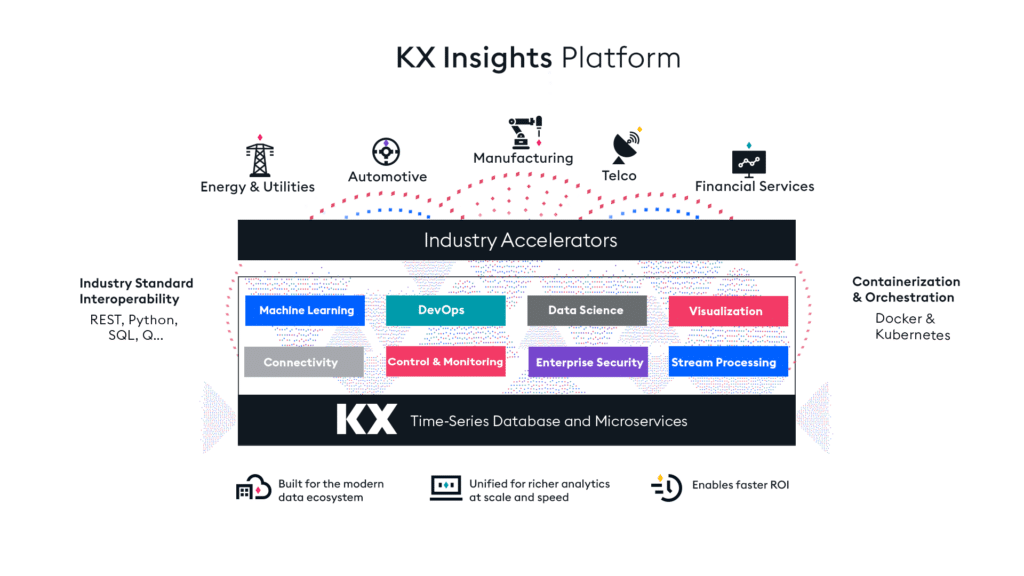

KX Insights is an integrated data management and streaming analytics platform that provides that ability, enabling critical business decisions that require the power of streaming data enriched with historic context. It leverages industry standards to ensure openness and interoperability with other technologies in capturing, storing and processing high-volume, high-velocity data and delivering insights instantly.

Faster time to model

Ingest, store, manage, analyze and effortlessly visualize vast volumes of data at scale and speed, using familiar tools and existing libraries to leverage the capabilities of the world’s fastest time-series database and analytics engine.

Better performing trading strategies

Build and deliver algorithms that are better informed, modeled, tested, and more successful than your competitors – crafted upon insights from streaming market data and enriched with historical pricing patterns from virtually any data resource.

Measure performance and impact

Better informed equals better outcomes. CEP, fast aggregation, and real-time analytics of market data reduce latency and eliminate the delay of batch. Highly flexible dashboards deliver continuous insight and accelerate the path to Alpha.

Algos may be designed for success, but they need smart execution to realise it. An initial strategy based on historical prices and assumptions about future volatility may project a timeline and trading profile that seeks to minimize slippage and market impact based on those parameters. But it must be continuously monitored and adjusted as markets evolve to ensure it retains its coherence and those design objectives. Reacting at the speed of those market events requires a fast technology, but responding in an informed, directional way requires an even faster one. That is the purpose of a streaming analytics platform, and that is the function of KX Insights

For more information on KX Insights, please visit our website, www.kx.com, or contact us at kxsales@kx.com.