Financial Services

Optimizing trading, risk analytics, and decision-making in the era of AI.

Managing the new data landscape in financial services

The nature of data is changing, with the volume, velocity, variety, and complexity of data exploding. Consequently, decision-makers in finance are encountering critical challenges:

Data dependency

From volume to storage, the need to store and access historical or real-time data is compounding.

Milliseconds count

Teams cannot leverage real-time data with the necessary speed and precision to drive success.

Harnessing all available data

Failing to leverage historical and unstructured data and inability to backtest with sufficient rigor.

Inefficient data infrastructure

Optimize infrastructure for maximum performance and data accuracy without unnecessary costs.

Proof points

We partner with the world’s leading investment banks and hedge funds to tackle complex data challenges that enable faster and better-informed decision-making.

Accelerated insights

Powered by the world’s fastest data analytics platform*

Unified data platform

Single destination for all data types you depend on

Trusted by the best

Proven at the world’s largest financial institutions

* Independently benchmarked by STAC Research

How we help

PRE-TRADE ANALYTICS

Accelerated insights with unmatched scale and precision

Outdated trade lifecycle analytics can undermine performance and strategic initiatives. The KX AI and analytics platform enables the creation of a digital twin of capital markets, providing real-time insights into post-trade analytics performance.

POST-TRADE ANALYTICS

Optimize trading strategies with advanced modeling

Processing complex market data can be daunting. Our technology delivers analytics on extensive volumes of historical data, providing valuable insights for future order execution.

QUANTITATIVE RESEARCH

Expedite insights and model accuracy

Quants often struggle to test research models accurately at the required speeds. Our platform overcomes these limitations by enabling more timely and precise decision-making.

BACKTESTING

Rapid testing, enhanced accuracy, and scalable backtesting

Speed and accuracy are crucial when backtesting trading strategies using historical and real-time data. Our vector-native products allow for the development of more accurate trading strategies, allowing for rapid simulations of trading hypotheses at scale.

REAL-TIME VISIBILITY

Gain instant access to live data and accelerate decision-making

Financial services organizations face significant obstacles in their real-time decision-making processes. Our platform processes data sets within milliseconds, enabling trading desks to monitor real-time conditions, seize market opportunities, and negate threats.

PATTERN AND TREND ANALYTICS

Detect patterns, identify anomalies, and stay ahead in fast-moving markets

Seamlessly analyze data patterns, compare market activity, and detect anomalies as they occur, allowing you to stay ahead of any potential issues, take advantage of opportunities, and more efficiently manage risk.

Agentic AI use cases

KX and NVIDIA have partnered to create a new standard for AI in capital markets. The collaboration combines our real-time, time-series data analytics with NVIDIA’s GPU acceleration and model development ecosystem. Our agentic AI use cases help you unlock new revenue opportunities, improve customer satisfaction, expand fee-based offerings, and drive growth in assets under management.

Expand coverage and accelerate insights

Accelerate insight generation by giving analysts, quants, and researchers the ability to ask natural language questions and get accurate, explainable outputs grounded in live and historical data.

- Query structured and unstructured sources in one step

- Automate peer comparisons, trend analysis, and event tracking

- Publish fully sourced, client-ready outputs in seconds

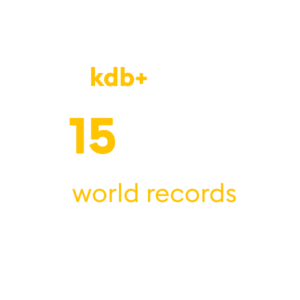

Built for efficiency

STAC, the industry standard for testing financial time series data, consistently recognizes KX for its world-class query execution times in their benchmark reports.

STAC represents an independent, audited set of data analytics benchmarks and offers a valuable service to FSI businesses by means of “cutting through” proprietary marketing benchmarks from technology vendors.

Additional features

Enhance your kdb Insights Enterprise experience with these additional features.

Feedhandlers

Ingest, process, and distribute data from multiple sources including financial exchanges, news wires, and more, directly into your instance with minimal latency to enrich your workflow. Cleansed data integrates immediately into kdb Insights with pre-packaged ETL pipelines to provide you with a competitive edge through timely and efficient use of market data.

Demo the world’s fastest database for vector, time-series, and real-time analytics

Start your journey to becoming an AI-first enterprise with 100x* more performant data and MLOps pipelines.

- Process data at unmatched speed and scale

- Build high-performance data-driven applications

- Turbocharge analytics tools in the cloud, on premise, or at the edge

*Based on time-series queries running in real-world use cases on customer environments.

Book a demo with an expert

"*" indicates required fields