Key Takeaways

- The AI banking agent enables more profound decision-making by infusing AI into complex processes. It leverages historical context, client context, strategic directives, and human-in-the-loop guidance to improve outcomes in areas such as quantitative trading, risk management, and research.

- It unifies structured and unstructured information in a high-performance system. This addresses the fundamental need for businesses to access and analyze multiple types of data to answer complex questions.

- The convergence of speed, computational scale, and human intelligence, as demonstrated by the AI banking agent, represents the future of knowledge work.

Your financial advisor just gave you a better, smarter, faster answer to your question, thanks to AI. Here’s how it worked.

Sarah stares at her screen. Tariff news just hit the wire. She needs to analyze its impact on Tesla and comps. Quickly. She wants to start by comparing this news to Tesla’s supply chain disruptions during COVID-19 — she senses similarities. Then she needs to decide how to engage clients. Sarah doesn’t reach for reports or Excel; she asks her AI banking assistant to do deep research: “How did supply chain disruptions affect Tesla stock during COVID, what similarities might occur based on this tariff news (here’s a link to details), and which clients should consider portfolio adjustments now? Create three scenarios with a rationale about how Tesla stock will react.”

Minutes later, Sarah has a report of Tesla’s stock performance from March 2020 through December 2021; key impacts on Tesla manufacturing from analysts; key findings from last month’s industry report on EV supply chains; three stock movement scenarios; and a list of high-net-worth clients who changed their Tesla position in the past six months. She follows up with more prompts.

20 prompts and two hours later, she’s ready. Sarah’s AI assistant didn’t just make her move faster; it helped her think faster. She explored insights she wouldn’t have otherwise had time to explore. She found key insights among thousands of pages of company filings. She matched her most surprising findings to clients who are most likely to want to act. AI even identified five clients who specifically expressed concern about the impact of tariffs. She calls them first.

The barriers to making enterprise AI work

Sarah’s investment advisory system is powerful but hard to implement in most financial firms. Foundational AI models fail when questions get real. They lack client context. They depend on public information. They don’t have detailed enough market data. They can’t correlate client data with market context.

The problems are many, but not insurmountable. Workflows must be redefined. Real-time data must be integrated with LLMs. Compliance. Security. Privacy. Prompt engineers must craft questions that guide AI to meaningful, hallucination-aware insights.

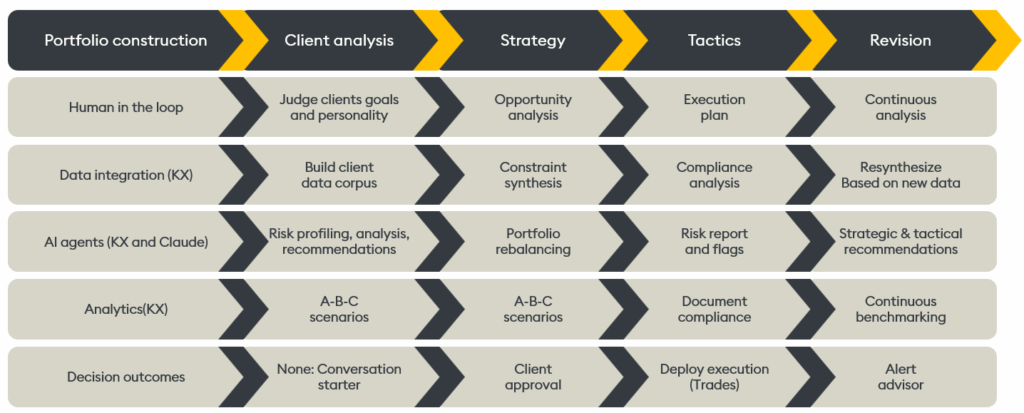

The first step to redefining advisory workflows in banking is the decision-making process itself, and rethinking how AI augments each step of the jobs to be done by the analyst: AI-augmented analysis, strategy, execution, and revision.

The KX AI banking assistant was designed with these advisory workflows in mind. Built in partnership with leading investment banking firms, the AI banking agent surrounds human-in-the-loop ideation and decision outcomes with data, AI agents, and analytics in a new AI-centric workflow, as shown below.

A day in the life of AI-augmented portfolio strategy and execution

The agentic banking solution: Data, agents, and analytics

Three AI elements form the “beef” in the sandwich: data, AI agents, and analytics.

AI-ready data securely integrated three levels of data with LLMs and agentic workflows: public filings (millions of unstructured SEC documents), time-series market data, and internal research and client intelligence to apply the best insights to interested clients with accurate context.

AI advisor agents are fine-tuned to answer analyst questions at the right time with the right data. It tunes LLMs to understand: Do I need a moving average to answer this question about performance? Over which time period? Should we analyze OHLC data for specific dates based on when supply chain news broke? AI banking agent helps make these analytical choices based on the context of the query.

Finally, analytics logs every AI interaction and recommendation, which is logged and characterized for continuous governance and financial operational control.

Throughout the workflow, Sarah receives insights that would typically require teams of financial specialists, data scientists, and data engineers weeks or months to uncover. Sarah spends more time connecting dots than grappling with data, yielding truly novel insights and recommended best actions.

Two key elements enable the AI banking assistant to operate at scale: interactive analysis speed and massive neural scale.

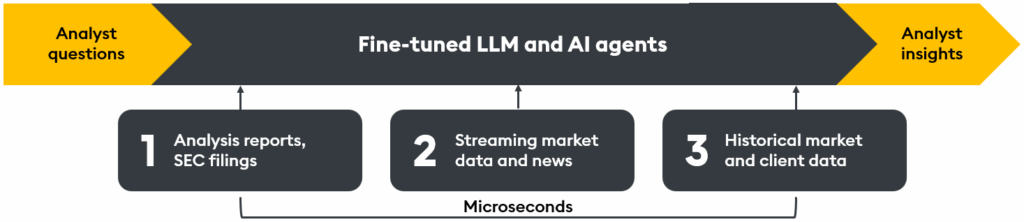

Critical element one: Microsecond latency

Real-time trading blotters revolutionized Wall Street decades ago because they put market data at the fingertips of traders; Real-time interactive AI agents do the same for neural networks and their insight-generating power. But Wall Street systems, where market data changes 10’s of thousands of times a second, must be built for, in some cases, microsecond latency.

The AI banking research assistant leverages streaming time series data, NVIDIA GPU power, and unstructured data to answer financial market questions in microseconds with up-to-the-millisecond, fresh market data. It does this by converting Sarah’s questions into embedded vectors with over 1,536 floating-point numbers that represent the semantic meaning of each question. It then compares this question vector against millions of document chunks, each also represented by 1,536 values, as well as streaming and historical market data.

1,536 data points multiplied by 1,536 calculations is over 2.3 trillion mathematical operations. Most systems can’t even complete this comparison; the KX AI Banker does it in microseconds. GPUs, temporal data, and vectorized data formats, coupled with the LLM of your choice, are the ingredients AI banking assistant’s secret sauce.

Think of it as comparing your fingerprint (your question) to a million fingerprints (your portfolio, market, and strategy corpus), all at once, instantly.

But speed, as they say on Wall Street, is table stakes. What makes AI banking assistant insights truly transformative is how it leverages neural networks to combine macro market context, micro market data, and personalized answers to infinitely interesting investment questions.

Critical element two: Leveraging neural networks to explore millions of investment angles

But speed alone isn’t the competitive advantage. The real power of AI lies in its ability to connect the dots: its capacity to consider hundreds, thousands, or millions of scenarios and moves based on simple natural language questions, as well as massive, real-time datasets. For example, a single query about Tesla’s COVID performance might trigger 50 separate vector searches across different document types and periods.

What takes competitors minutes happens in milliseconds with the AI banking agent, creating an entirely new category of what’s possible through multimodal, temporal AI analysis.

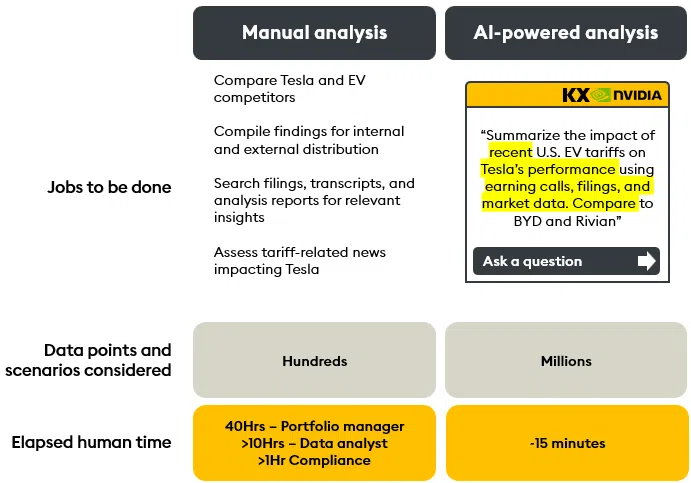

Manual versus AI-augmented evaluation of the impact of new tariffs on Tesla

Analyze filings, earnings calls, compare peers, market data, summarize impact, and check compliance

Let’s dissect a single AI banking assistant analyst question: “Summarize the impact of recent U.S. EV tariffs on Tesla’s performance using earnings calls, filings, and market data. Compare to BYD and Rivian.”

One head of research estimates that this question would ordinarily take over 50 hours of portfolio manager, data analyst, and compliance time to even approach an answer to consider hundreds of scenarios and sensitivities. AI can explore orders of magnitude larger possibility spaces, orders of magnitude faster than purely human workflow, using traditional analytics tools or manual, interactive programming.

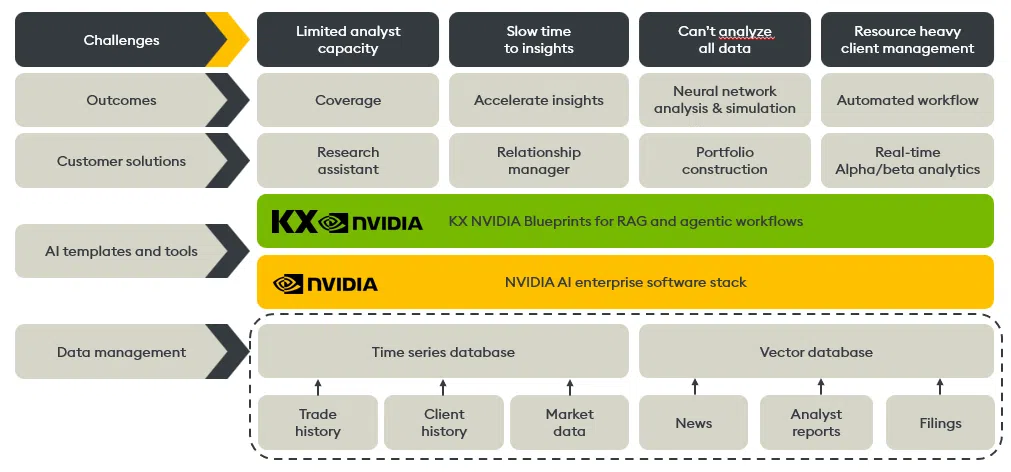

The unified KX AI banking assistant architecture advantage

Traditional portfolio and market analysis cobble together technologies to approximate what the AI banking assistant does with one system. Pinecone for document vector storage. ClickHouse for structured data. KX for market data. Each system speaks a different language. Data moves slowly between them. Integration is a nightmare.

KX built something different. KDB.AI handles unstructured data. KDB+ for structured, streaming, and historical market data. The LLM of your choice. One unified architecture. The same natural language queries work across the entire dataset. Data doesn’t travel between systems because it lives in the same ecosystem.

This architectural unity means the system can perform analyses that would be impossible with traditional setups. When Sarah asks about Tesla’s supply chain issues, the AI banking assistant simultaneously searches SEC filings for relevant text, queries stock price databases for historical performance data, assesses real-time market prices and trading volumes, and checks internal client records for trading activity. All these searches happen in parallel, using the same underlying technology.

The AI banking assistant advantage isn’t just technical; it’s also operational. Banks don’t need to manage multiple vendors, integrate disparate systems, or worry about data synchronization. Everything works together because it was designed as a cohesive unit. Implementation can happen in weeks instead of multi-year integration projects.

But the AI banking agent enables something more profound.

The AI banking assistant is a template for any AI-infused decision

The same technology that helps Sarah analyze Tesla’s COVID performance can infuse AI in any complex decision-making process that can benefit from historical context, client context, strategic directives, and human-in-the-loop decision-making guidance. Quantitative trading desks. Researchers can backtest thousands of algorithmic strategies in the time it previously took to test dozens. Risk managers can simulate market scenarios across multiple asset classes simultaneously.

The applications extend beyond the financial markets. Any industry that combines structured data with unstructured documents can benefit from this approach. Healthcare systems could analyze patient records in conjunction with medical research. Manufacturing companies could correlate production data with supply chain documentation. Legal firms could search case law while analyzing contract databases.

Most business questions require multiple types of data. The KX approach of unifying structured and unstructured information in a single, high-performance system addresses this fundamental need.

AI banking agent isn’t just a better banking tool. It’s a new category of business intelligence that could reshape how organizations access, analyze, and decide on massive volumes of information, both structured and unstructured.

The seven microseconds that power Sarah’s Tesla analysis represent something larger: the moment when AI systems become fast enough to think alongside human experts. In that convergence of speed, computational scale, and human intelligence, the future of knowledge work begins to take shape.

Learn more about KX’s agentic AI use cases, including the AI research assistant at kx.com