Key Takeaways

- AI-powered temporal similarity search helps compliance teams spot suspicious trading patterns instantly, safeguarding market integrity amid complex manipulation tactics.

- Machine learning models like “Temporal IQ” automate anomaly detection, scoring, and alerts, speeding up compliance investigations.

- Similarity search algorithms reveal hidden links between trades, exposing complex manipulation schemes like spoofing, front-running, and insider trading.

- Using platforms like Apache Kafka and KX ensures risk management decisions rely on real-time, accurate market data.

- Firms must tackle data quality, regulatory transparency, and false positives to optimize AI-driven compliance solutions.

In an era where trading volumes surge by the millisecond and market manipulation tactics grow increasingly sophisticated, temporal similarity search is emerging as a vital tool for compliance teams, enabling real-time detection of suspicious trading patterns and safeguarding market integrity.

In the digital heart of a leading capital markets institution, an AI-powered surveillance system hums quietly, analyzing millions of streaming market data points per second for anomalies. Built on technologies inspired by AI similarity search, it continuously monitors trading activity for illegal patterns, augmenting trade compliance teams. Let’s examine a moment in the life of a real-time aberrant trading event.

A moment in the life of an anomaly

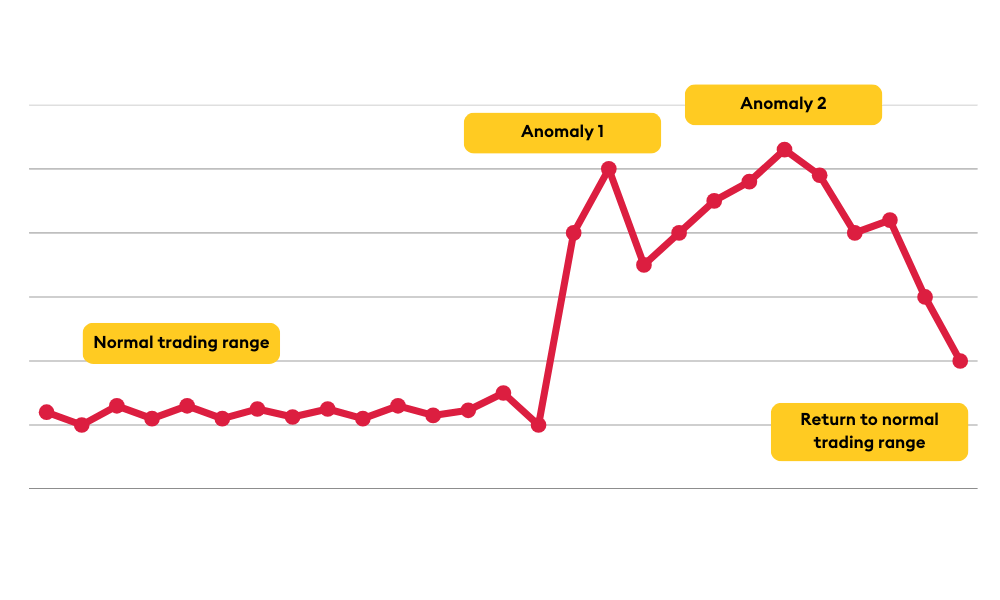

An anomaly occurs at 10:43 a.m. An AI algorithm called “Temporal IQ”—a set of algorithms and high-speed computing agents designed to detect aberrant time-based (temporal) activity patterns—identifies a flurry of large buy orders for a low-volume mid-cap tech stock flooding the market. The question must be answered quickly: Is this a mistake? An innocuous trading action? Or, worse, could it be a fraudulent trading pattern?

At first glance, the pattern resembles the classic pump-and-dump market manipulation: a rapid uptick in price followed by a short burst of profit-taking. Temporal IQ algorithms flag the activity as suspicious and raise a Level 1 “Anomaly 1” alert to the trade compliance team.

After a brief dip, the price continues to climb. A surge of orders is canceled, followed by sell orders from the same trading account that triggered Anomaly 1. This aligns with the “trade spoof” pattern, where large orders are placed to artificially move the market, followed by cancellations and trades in the opposite direction to profit from the price movement.

After a brief dip, the price continues to climb. A surge of orders is canceled, followed by sell orders from the same trading account that triggered Anomaly 1. This aligns with the “trade spoof” pattern, where large orders are placed to artificially move the market, followed by cancellations and trades in the opposite direction to profit from the price movement.

Trained machine learning models evaluate this temporal pattern, scoring it based on order size, timing, and the trader’s historical behavior. In this case, the score of Anomaly 2 exceeds the Level 4 (serious) threshold. The system captures a snapshot of trading data around the anomaly and sends a Slack message with the data to the relevant trading surveillance team member.

AI algorithms execute this entire process on the fly. After just 10 seconds of activity, the system surpasses the Level 4 threshold, and the alert is sent milliseconds after the second escalating anomaly.

In the compliance department, a screen flashes red. A detailed report with visualizations of the order book and trade execution timeline appears. It’s the first Level 4 trading anomaly of the day, flagged within a system monitoring 100,000 daily trades.

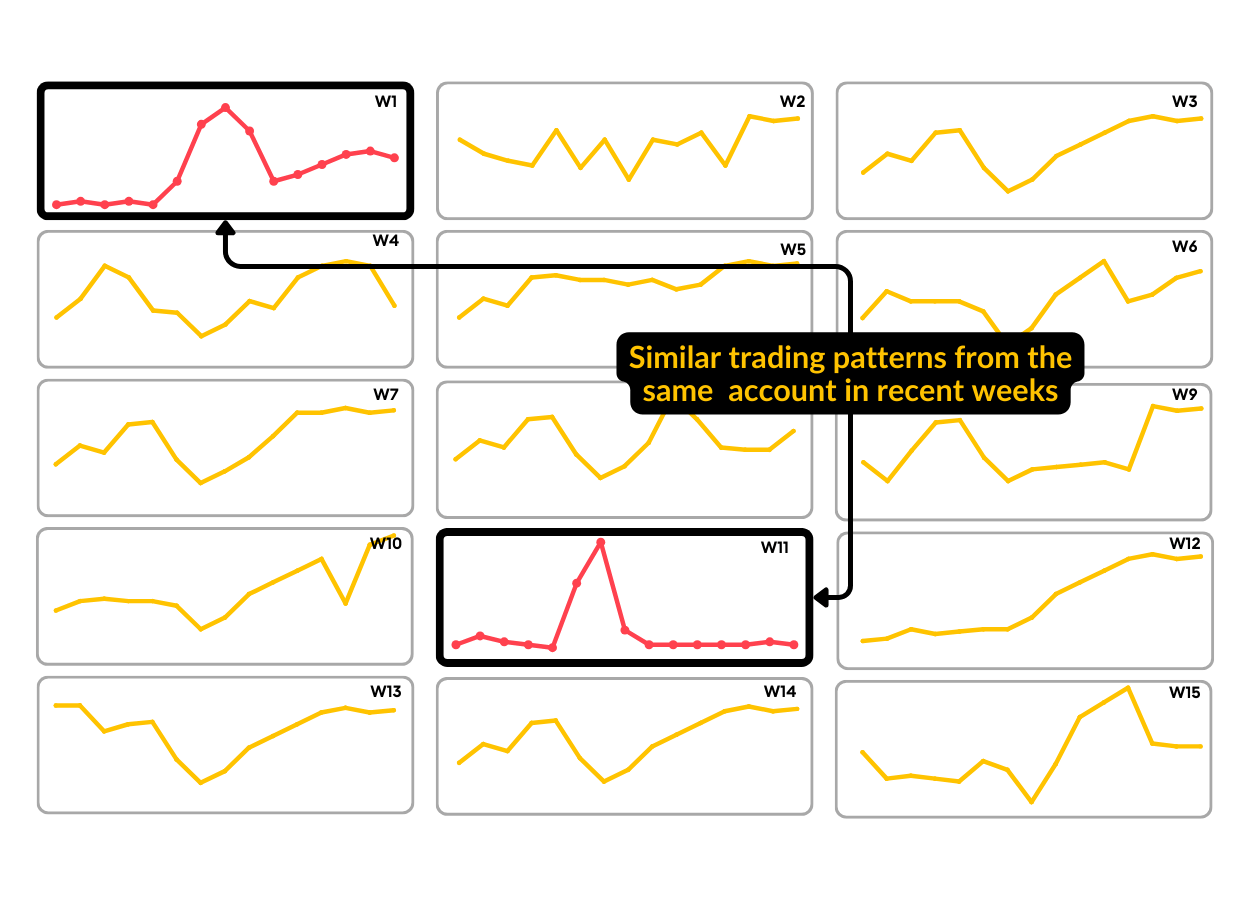

The compliance team begins its research. Sometimes, trading patterns like this are intentional; other times, they’re merely aberrations. To determine which this is, the team examines the trading account’s history. Using an AI-based similarity search, they find two similar patterns associated with this account.

They use these time windows to compare today’s market conditions with those from the previous patterns. Accessing historical tick store archives via Tableau, they analyze order volumes, news events, and other market conditions from Week 1 and Week 11.

Although the patterns may look dissimilar to the untrained eye, the head of compliance knows to search for irregular pattern sets. Like using MidJourney to create the perfect image still forming in your mind, skilled compliance officers recognize that market manipulators often mix schemes like spoofing, “123-go” trading, and pump-and-dump tactics to evade detection.

Meanwhile, the surveillance system adds the trading account to its high-priority watch list, maintaining vigilance for further suspicious activity.

The power of AI in risk management

This moment exemplifies the power of AI, streaming data, and similarity search in protecting market integrity and ensuring fair trading practices. AI-powered systems can analyze vast amounts of data in real time, identifying patterns and anomalies that human analysts might miss. These systems can:

- Detect unusual trading patterns

- Predict the risk level of anomalous activity based on historical data and current market conditions

- Automate alerting

- Augment analysts by speeding time to insight for research, pattern comparisons, and enhanced surveillance

For example, machine learning models can be trained to recognize subtle indicators of front-running, such as suspicious order timing or unusual price movements before large trades. By leveraging streaming data platforms like Apache Kafka, KX, Confluent, or TIBCO, financial institutions can build robust streaming data pipelines, ensuring that risk management decisions are based on the most current information available.

Temporal similarity search: Uncovering hidden connections

Similarity search algorithms play a critical role in identifying patterns and relationships that may signal illegal trading activities. These techniques can be applied to various aspects of trading data, including:

- Transaction patterns

- Trading strategies

- Communication networks

By using advanced similarity search methods, such as graph embeddings, compliance teams can uncover hidden connections between seemingly unrelated trades or traders. This is particularly useful in detecting complex schemes involving multiple parties or accounts.

Let’s explore some specific ways these technologies can be applied to combat illegal trading practices:

Applications of temporal similarity search

- Front-running detection: AI models can analyze order flow and execution data in real time, flagging suspicious patterns indicative of front-running. By comparing the timing and size of trades across accounts, these systems identify instances where traders may exploit privileged information.

- Insider trading prevention: Similarity search algorithms can detect abnormal trading patterns among corporate insiders. By analyzing historical data and comparing it with current activity, these systems flag suspicious trades potentially based on non-public information.

- Market manipulation detection: Streaming data analysis identifies coordinated trading activities that attempt to manipulate prices. AI systems can detect patterns such as spoofing or layering by processing vast amounts of order book data in real time.

Challenges and considerations

While these technologies offer powerful tools for risk management and compliance, there are several challenges to consider:

- Data quality and integration: Ensuring clean, consistent data across multiple sources is crucial for effective analysis.

- Regulatory compliance: AI systems must be designed and implemented in a way that meets regulatory requirements for transparency and explainability.

- False positives: Balancing sensitivity with accuracy to minimize false alarms is an ongoing challenge.

Conclusion

As regulatory scrutiny intensifies and markets become more complex, investing in these advanced technologies is not just a competitive advantage—it’s a necessity for maintaining market integrity and protecting investors. The future of trading risk management and compliance lies in harnessing the power of AI and data analytics. Temporal similarity search is one method firms can use to create more transparent, fair, and efficient financial markets.

Explore the power of temporal similarity search in Mark Palmer’s blog, Understanding the heartbeat of Wall Street. Learn how KX transforms pattern and trend analytics to drive smarter decisions.