by Steve Wilcockson

The goalposts just moved in capital markets. That doesn’t happen everyday. As per the sports pitch sidelines, capital markets leaders will re-assess their set-plays and identify new tactics to determine winners and losers amidst a tornado of change. I’ve lived through three such changes in my work career, the creation of new financial instruments, then the introduction of HFT, and post-GFC wave of regulation. What’s interesting is that in all three cases, AI was on the sidelines, the substitute desperate to come on, to change the game. When it did, the captains and experienced players on the pitch kept it in check, however exciting the talent.

Generative AI is my fourth massive career tornado, and with it AI uniquely drives the game. Following the sports analogy, it combines an elevated supersub – the hitherto checked talent of discriminative AI – driving the play with the new kid with the seemingly unlimited potential – generative AI – delivering creativity and content. No longer do the aging Lionel Messis and Tom Bradys of Capital Markets (I won’t name any) drive the new plays. The supersubs and wizzkids of all genders and ethnicities are in town, reinvigorating a relatively static industry.

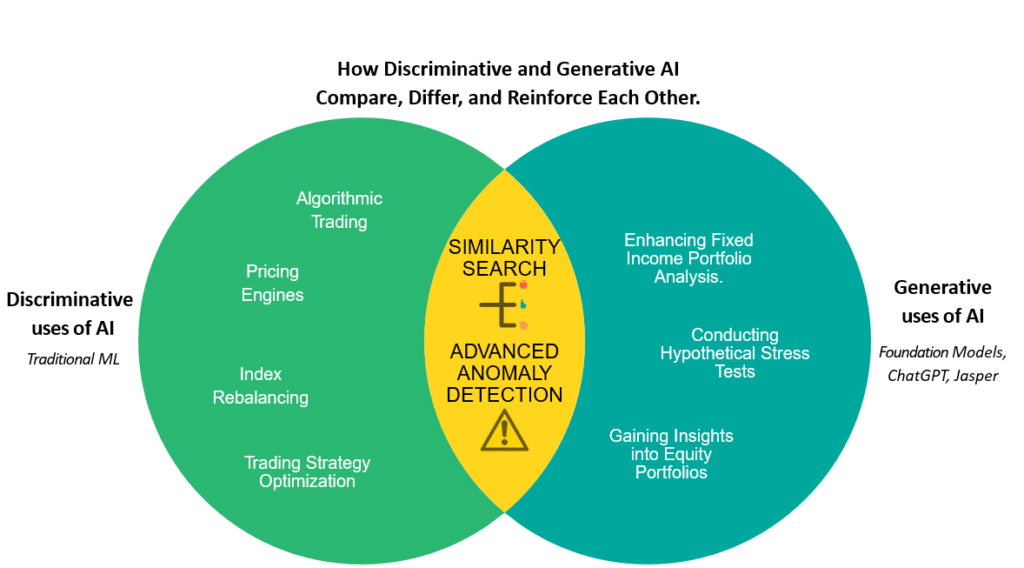

You get the drift. In today’s rapidly evolving capital markets, leveraging advanced exciting technologies better is essential to winning. Getting right down to the tech heart of it, that intersection of discriminative AI and generative AI offers massively exciting fast-paced possibilities for new wealth-creating opportunities, and yes, new risks to manage.

Let’s try and take a half-time breath amidst gameplays, and quickly explore how Discriminative and Generative AI compare, differ, and reinforce each other.

In simple terms, both types of AI build on machine and deep learning models that seek to understand and learn from data, and deploy that understanding in other situations. In the case of [exciting, young] generative AI, new data gets created as text, code, music, and content, while [worldly-wise, hitherto game-changer supersub] discriminative AI finds real answers and solutions in new data sets.

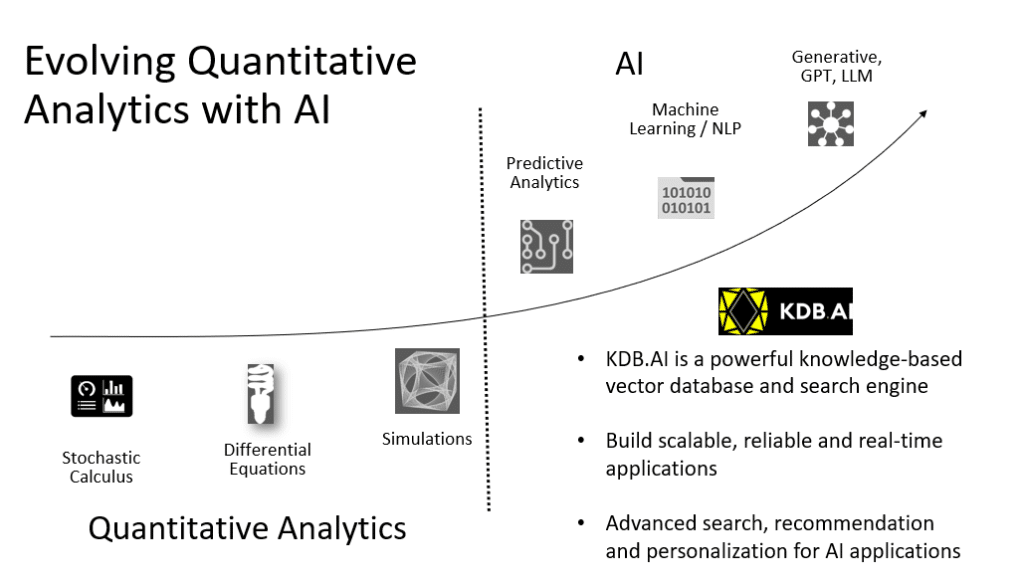

This leads to fantastic opportunities at the intersection of both types of AI. On one hand Large Language Models (LLMs) walk hand-in-hand with generative AI, while Large Data Models (LDMs) historically underpin discriminative AI and can also, when suitably deployed, can accelerate and add precision to generative AI. Together, they formulate unique combinations of valuable specific solutions and insightful scenarios with context.

KDB.AI, a cutting-edge vector database, is at the forefront of revolutionizing the way financial institutions tackle complex challenges using both types of AI. It is unique because it has the storage and compute capabilities to work with both types of AI, together. It is the only no holds barred database able to accommodate the experienced and demanding discriminative AI super-sub with the bright new unique generative AI talent. All vector databases are not built equal.

In the remainder of this article, we explore real identified key use-cases for KDB.AI in capital markets and illustrate how it uniquely empowers financial professionals to make informed decisions, with context. These are not dreamed up art-of-the-possible cases, they are real scenarios where industry game-changers deploy both discriminative and generative AI technologies at the cutting edge.

Example 1: Enhancing Fixed Income Portfolio Analysis.

Consider a scenario where a bank evaluates a fixed income portfolio consisting of 100 OTC bonds, each with non-standard terms embedded within PDF documents. By utilizing KDB.AI, the bank can leverage LLMs to classify and categorize these bonds accurately. Additionally, with the power of LDMs and similarity search, the bank can identify pricing information for instruments closely matching the portfolio constituents. A pertinent question to ask KDB.AI in this case, identifying specific solutions and contextual information, would be, “Can you provide me with pricing details and a summary of risks (liquidity, counterparty/credit risk, market risk) for the portfolio, along with confidence intervals?”

Example 2: Gaining Insights into Equity Portfolios

For investors managing equity portfolios, KDB.AI can prove invaluable in providing actionable insights. Let’s say you have a portfolio of 30 equities, and you want to analyze the exposure of your investments. KDB.AI enables you to ask specific questions to gain comprehensive information. You can inquire, “Based on my portfolio, how much revenue is generated from the ASEAN region today?” or “Could you provide me with a pie chart of employees broken down by country from my portfolio?” Additionally, you can delve into ESG factors by asking KDB.AI to estimate the ranking of companies in your portfolio from, say, a gender equality perspective.

Example 3: Conducting Hypothetical Stress Tests

By leveraging historical market events and real-time data, KDB.AI assists in understanding potential portfolio outcomes, for example by conducting hypothetical stress tests. Suppose you have a portfolio of 30 equities and want to assess the impact of specific events. You can ask KDB.AI questions like, “What would happen to my portfolio if AWS missed their earnings next week?” or “How would my portfolio be affected if the ECB raised interest rates unexpectedly next week?” Moreover, you could identify specific stocks in your portfolio universe with the highest price sensitivity to events such as a data breach, all at the push of a button or a verbal prompt.

KDB.AI is revolutionizing the way financial professionals analyze and manage portfolios in capital markets. By combining the power of discriminative AI, generative AI, LLMs and LDMs, it provides an unprecedented level of insight and decision-making capabilities that single-task vector databases just cannot reach. It uniquely draws on the talents, in AI terms, of the experienced super sub stepping up to drive the team, and the bright young star building new creativity. Whether classifying fixed income instruments, analyzing equity exposures, or conducting hypothetical stress tests, KDB.AI empowers financial institutions to navigate complex market dynamics with confidence. Embrace the future of data-driven finance with KDB.AI and unlock new possibilities for your organization’s success.

To learn more about KDB.AI and its applications in Capital Markets, please visit KDB.AI.