Wall Street data is different from Main Street data. The capital markets generate data that can change hundreds of thousands of times a second. Traders use this to make split-second, high-value, risk-laden decisions. Then use quantitative analysis and AI to assess and adjust decisions in real-time.

Banks are notoriously secretive about the tools, techniques, and innovations they employ to power this machine. This webcast peeks behind that veil of innovation.

Over 60 minutes, I (Conor Twomey, Head of AI Strategy, KX) was joined by Mark Palmer (Time Magazine Technology Pioneer) to explore Wall Street’s leading-edge applications of high-frequency data in trade ideation, intelligent trade execution, and continuous risk management.

What will you learn from the session?

Key takeaways

- How high-frequency, low-latency data impacts decision-making, and the computing physics of how this impacts data analytics

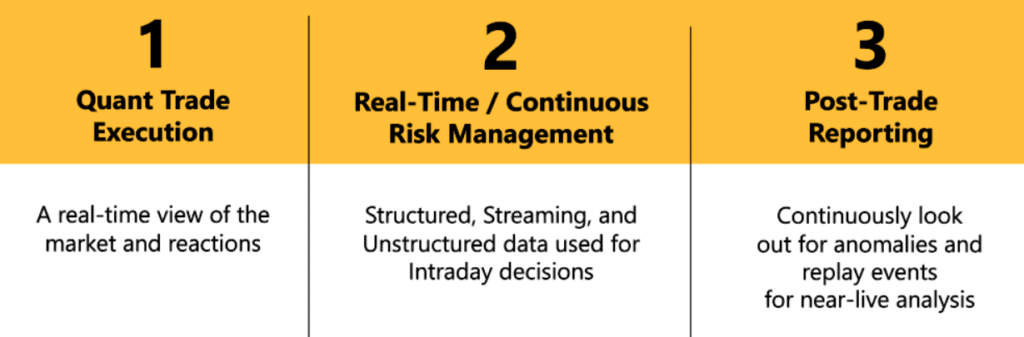

- A deep dive into three key trading use cases: Quant trade execution, continuous risk management, and post-trade reporting

- Three innovative ideas you can use to tackle these use cases:

You’ll also learn …

- The time-to-value curve of real-time and historical data

- The impact this has on how analytics tools are used and configured to assess market conditions and assist decision-making

- The implications of handling data with uncommon volumetrics, such as: 50 billion events a day, data ingestion with millisecond latency and multi-terabyte intraday data organized by time

Additionally, you will discover how clever firms are using large language models (LLM), GenAI, and machine learning in unique ways to fuse unstructured data (SEC filings, analyst reports, news) with high-speed, structured, market data to gain detailed insights and identify opportunities.

If you found this session useful, you can download our associated eBook: 7 innovative trading applications and 7 best practices you can steal.