The case for Real Time Trade Surveillance in accordance with the FX Global Code

By Rich Kiel

The FX Global Code, originally released in May 2017, is a set of global principles of good practice developed to provide a common set of guidelines to promote the integrity and effective functioning of the wholesale foreign exchange market.

As per the Global Foreign Exchange Committee, “the purpose of the Global Code is to promote a robust, fair, liquid, open, and appropriately transparent Foreign Exchange (FX) market in which a diverse set of participants, supported by resilient infrastructure, are able to confidently and effectively transact at competitive prices that reflect available information and in a manner that conforms to acceptable standards of behaviour.”

Now 18 months in, the adoption and the benefits of the Code are becoming clear. Hundreds of financial institutions have publicly declared their support of the Code by signing a public register. Increasing levels of transparency, and the growing use of advanced analytics, are demonstrating that market participant behavior is improving. Principle 17 of the Code particularly focuses on ‘Last Look’ which is a practice utilized in electronic trading whereby a market participant receiving a trade request has a final opportunity to accept or reject the request against its quoted price, often referred to as a hold time. A reduction in practices such as last look, as demonstrated by reduced or eliminated hold times, are being reported across industry platforms, and we are noticing improving trade execution via access to Transaction Cost Analysis reporting and other Best Execution analytics.

The question is whether principles-based regulation such as the Global Code, and the progress we are seeing, will be enough to ensure that the goals around integrity and conforming to acceptable standards of behavior will be achieved?

I’m not convinced they will be.

Many market participants have yet to sign up to the code. And for those who have, how can we really be sure that the principles it encourages are being adhered to? Daily turnover in the Foreign Exchange market exceeds USD$5 trillion per day. Dealers and investment managers are under greater pressure to perform then they ever have been. We would be naïve to think that a set of principles alone will eliminate bad actors and bad behavior with this much at stake. Therefore, adherence to the FX Global Code also requires systematic monitoring of the activity across an organization to ensure that the pillars of the Code around ethics, governance, execution, information sharing, and risk management are being adhered to. It also enables us to go from an environment where we deal with bad behavior after the fact, moving towards early detection, and ultimately the elimination of such activity.

Software solutions like KX for Surveillance are increasingly being considered a necessity for adherence to the code. With a Surveillance platform, a financial institution captures and consolidates all FX trading data across disparate, industry-wide platforms, plus internalized data. KX for Surveillance is already being used by many of the world’s leading banks, investment managers, exchanges and regulators. Its extensive library of scenarios monitors for misconduct across markets and platforms, detecting questionable behavior and signaling potential market abuse.

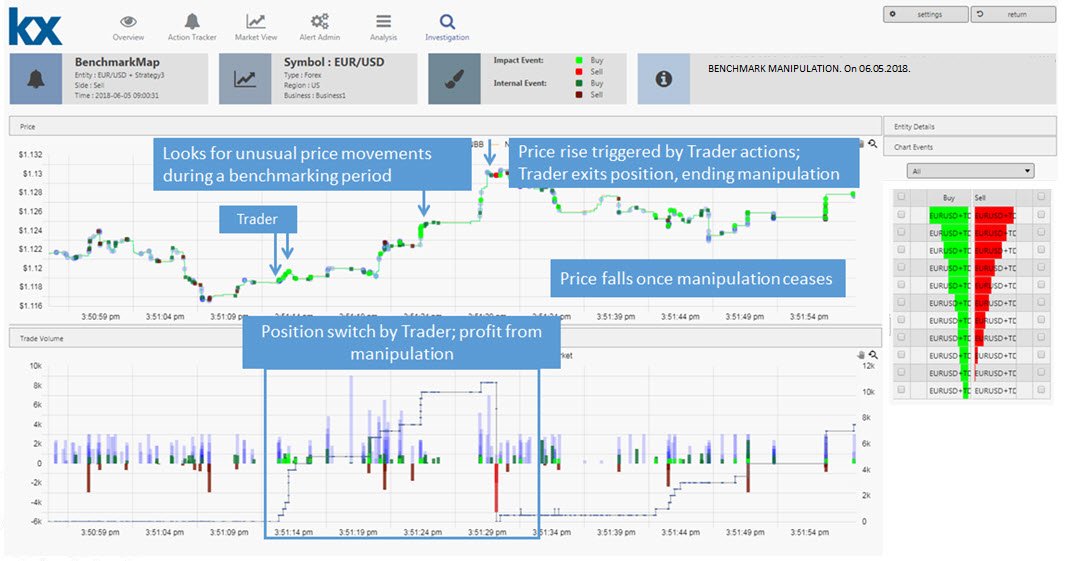

This combination of data, scenarios and investigation dashboards provides substantial efficiencies starting with early detection. Scenarios include collusion, benchmark manipulation, front running, excessive markup alerts and last look and are supported by rich visualization dashboards to facilitate immediate inspection and investigation. (See sample screenshot below)

With increasing market fragmentation, we are seeing exponential growth in the volume of FX order data now being generated with a requirement to store every update, from every liquidity provider across every platform. Most products and technologies struggle to process even a fraction of the data being generated. KX for Surveillance is based on kdb+ which has been the market leader for the last 25 years in processing huge time-series datasets and can process the required volumes with ease and in real time. This includes complex event processing, customized calculations and analytics and leading-edge data mining techniques along with the future integration of machine learning and artificial intelligence for advanced pattern recognition.

A set of principles will only get us so far but a combination of the continued adoption of the FX Global Code and a zero-tolerance policy when it comes to bad behavior combined with a sophisticated market surveillance platform built on market leading technology will ensure that the goals of the FX Global Code pertaining to integrity and that market participants conform to acceptable standards of behavior are being achieved.

To learn more about KX for Flow and our innovative Surveillance solutions, please visit us here.

Rich Kiel is SVP, Global Head of Forex Solutions at KX, currently based in New York City. He has extensive experience in the financial services industry including at UBS and Thomson Reuters.