- Products

- kdb+

- kdb Insights

- KDB.AI

- Delta

- Sensors

- Surveillance

- Market Partners

- Cloud Service

- AWS

- Azure

- Google Cloud

- Data Lake

- Snowflake

- Databricks

- Market Data

- ICE

- Services & Support

- Services

- Software Support

For over a decade, integrating Python and q has been crucial to the infrastructures of many of our largest clients. Seamlessly combining these technologies provides […]

Discover the secrets of the high-stakes world of capital markets, where trillions of events are processed daily, there’s no room for delay in our latest eBook.

Discover the secrets of the high-stakes world of capital markets, where trillions of events are processed daily, there’s no room for delay in our latest eBook.

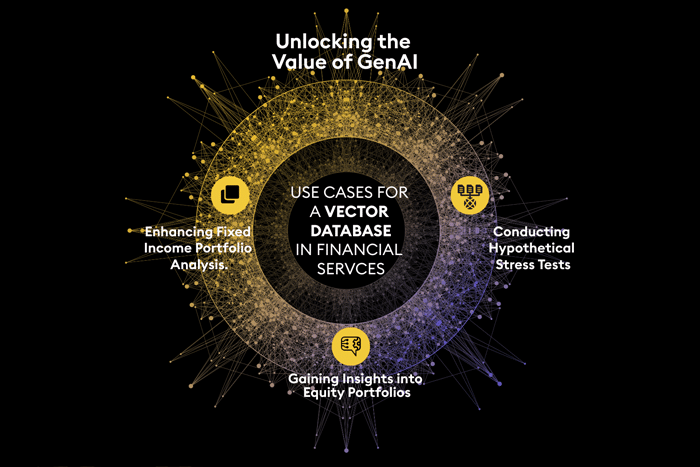

Discover the future of data management in Wall Street with our new eBook and dive into the evolution of streaming analytics, time-series data management, and generative AI.

Join Conor McCarthy (VP of Data Science) and Ryan Siegler (Developer Advocate) for a first look at PyKX 3.0

Our new whitepaper identifies the escalation of AI demands and the new challenges they bring to boards, technology providers, and consumers.