By Rory Cunningham

KX has a broad list of products and solutions built on the time-series database platform kdb+ that capitalize on its high-performance capabilities when analyzing very large datasets.

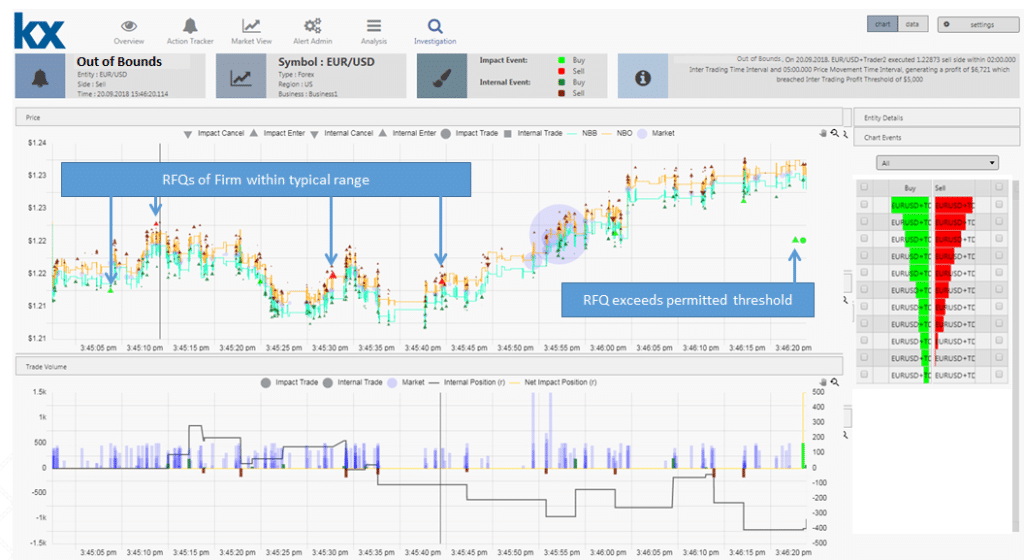

KX for Surveillance is a robust platform widely used by financial institutions for monitoring trades for regulatory compliance. The Surveillance platform instantly detects known trading violations like layering, spoofing or marking the close. Customers can calibrate their parameters in real time to improve their detection quality and accuracy. The flexibility of the historical database and replay engine eases retrospective investigation for new types of fraudulent behavior and suspicious activity.

In this series, we take a look at what makes KX for Surveillance such a powerful tool for detecting market manipulation. This article discusses the Quote Out Of Bounds alert.

Quote Out Of Bounds (QOOB) refers to a price posted by a trader that is out of line with an agreed market reference rate derived from quotes by representative Liquidity Providers (LPs) on the trading platform. QOOB’s are typically issued by trading firms who do not want to trade but are obliged, for various reasons, to quote two-way prices.

They are sometimes referred to as Stub Quotes and defined by the SEC as “an offer to buy or sell a stock at a price so far away from the prevailing market that it is not intended to be executed, such as an order to buy at a penny or an offer to sell at $100,000” [1]. Exchanges and brokers must be diligent in ensuring that they do not become either the platforms for, or the hosts of, those who seek to manipulate the market in this way under the cover of millions of streams of fast-moving data.

KX for Surveillance provides a robust solution for identifying QOOB. The kdb+ database that underlies it facilitates high-speed analysis of every individual event, private and market, and will generate a QOOB alert based on a range of concurrent processing steps including:

- Real-time updating of the reference price to ensure accurate assessment of potentially out of bounds quotes

- Continuously monitoring for breaches of defined thresholds

- Monitoring whether or not the quoted prices were later amended, cancelled or resulted in a trade

Price difference thresholds and other parameters including symbol and user IDs can be set via an Alert Administration dashboard. They may also trigger a supporting Profit & Loss Impact Value report that augments the investigation and helps determine the intent behind the pricing profile.

In the above, we can see how KX tracks and analyzes incoming quotes and sets a range in which the liquidity providers should be pricing to reflect market competitiveness. Once this threshold is breached an alert is generated, reporting the severity and disparity of the quote with regard to current market activity.

The value of what constitutes a large or small quote can either be fixed or continuously recalculated via benchmarking on a per entity basis. Benchmarking is the utilization of historical data in order to obtain a tailored threshold value for each entity value based on their normal trading characteristics. This approach helps reduce false positives and time spent on unnecessary investigations.

For more information on KX for Surveillance and its functionality please click on the link below.

[1] https://www.sec.gov/news/press/2010/2010-216.htm